IoT Analytics, this month launched the List of 700+ IoT system integration & services companies 2021, finding that among companies implementing IoT projects, 55% utilize a professional services firm or system integrator.

Key insights:

- Companies turn to integrators for their IoT projects due to lack of in-house knowledge, staff shortages, and the complexity of IoT setups.

- IoT Analytics published a list of 700+ system integration & services firms that are focusing on the Internet of Things.

- IoT integration is the most offered professional service and manufacturing the most targeted vertical by these 700 companies.

Key quotes:

- Knud Lasse Lueth, CEO at IoT Analytics, says: “Since 92% of surveyed senior information technology (IT) decision makers agree that “company-wide digitization” will be more important post-COVID-19, the role of the IoT integrator is critical. This importance is enhanced by the digital skills gap, which is the prime reason companies hire integrators.”

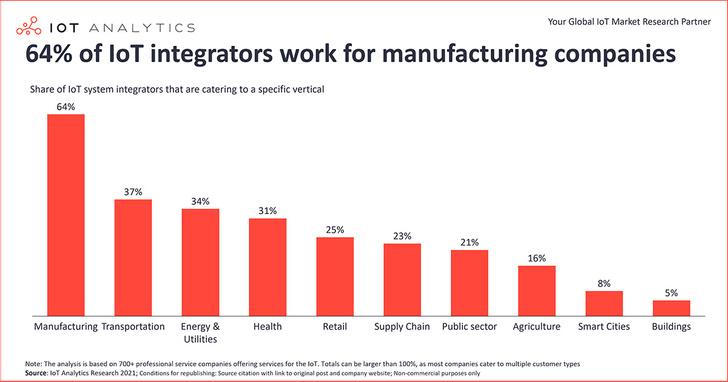

- Philipp Wegner, senior analyst at IoT Analytics, adds: “Different industries have different needs. A manufacturing company with a global network of plants has specific IoT system integration requirements that differ from an agricultural company or a healthcare company. Manufacturing clients are important to IoT integrators: 64% of IoT system integration companies focus on manufacturing, including smart factories, industry 4.0, and connected products. Transportation (e.g., connected car, vehicle-to-everything) is the second most common industry at 37%, followed by energy and utilities (e.g., smart metering and smart grid) at 34%.”

The critical role of the IoT integrator

When asked why they hired an IoT integrator, decision makers named a lack of internal experience (78%), staff shortages (72%), or complex technologies (71%).

Since 92% of surveyed senior information technology (IT) decision makers agree that “company-wide digitization” will be more important post-COVID-19, the role of the IoT integrator is critical. This importance is enhanced by the digital skills gap, which is the prime reason companies hire integrators.

The drivers of the $32 billion IoT system integration market Several trends are driving demand for IoT professional services:

1. Move to the cloud. For many companies, pushing existing workloads to the cloud is more complicated than anticipated. 2. New connectivity and hardware setups. IoT integrators support companies during changes or updates in IoT connectivity technology (e.g., transitioning to 5G or low-power wide-area networks (LPWAN)) and the continuous replacement and integration of more powerful edge computing devices as a part of hardware retrofits. 3. Scaling of IoT projects. Some IoT projects are scaling to thousands (sometimes millions) of devices. This is complicated and often requires outsourcing operations to service providers. 4. Data streamlining and analytics. System integrators are often called on to connect data streams and enable new software tools to leverage artificial intelligence (AI) and machine learning (ML).

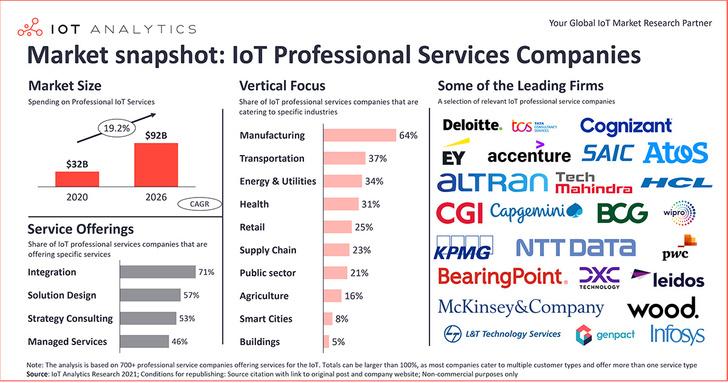

According to IoT Analytics’ IoT Enterprise Spending Dashboard, spending for IoT integrators and professional services is increasing in 2021. The IoT professional services market is expected to grow from $32 billion in 2020 to $92 billion in 2026.

At this rate, the professional IoT services market (with a 19.2% compound annual growth rate for 2020–2026) is poised to outperform the Professional IT services market. IoT services are expected to take a 6% share of the global IT and IoT services market by 2026.

The IoT integrators landscape – 700+ companies enabling the Internet of Things

The List of 700+ IoT system integration & services companies 2021 reveals the complexity of the IoT system integration market. IoT integrators focus on different parts of the value chain, industries, regions, and technologies. Finding the right IoT integrator for a project can be cumbersome given the myriad freelancers and small and medium companies focused on a local subset of the market. Many IoT integrators cater to specific needs and industries. The 700 IoT system integration companies identified in the list employ a combined work force of nearly 8 million professionals (although not all of them are focused on IoT).

1. Types of IoT integrators

The IoT integration market is led by large global IT and operational technology (OT) integrators, such as Tata Consulting (TCS), Wipro, Cognizant, and Accenture. Other specialized firms are entirely or largely dedicated to IoT (e.g., Concept Reply). In recent years, large cloud/hyperscalers, such as Microsoft or AWS, have built up IoT integration businesses and networks of affiliated partners that perform thousands of on-site implementations with clients. (Our research identified 133 Microsoft partners and 45 AWS partners focused on IoT).

Other large software or hardware companies also have dedicated IoT integration teams (e.g., IBM, Bosch, and Siemens Advanta). Finally, traditional consultancies and advisory businesses, such as PWC, McKinsey, BCG, and EY, provide IoT professional services.

2. Service and technology offering focus

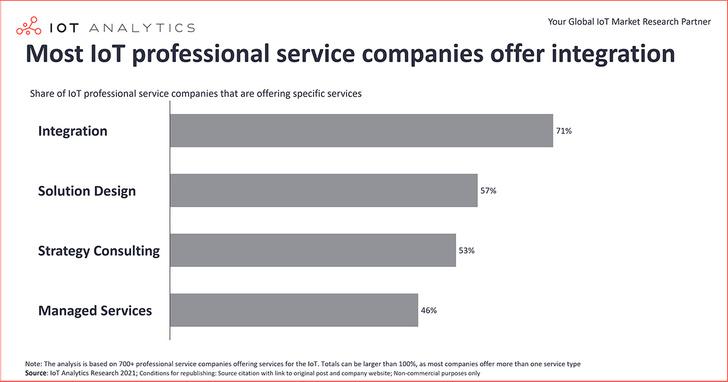

IoT Analytics has identified four different IoT system integration services: strategy consulting, solution design, integration, and operations/managed services. While many IoT integrators offer a holistic range of integration services, some provide a narrow set.

Integration (71%) is the most offered service across all identified companies, followed by solution design (57%), strategy consulting (53%), and operations/managed services (46%).

Nearly all (93%) of the identified system integrators cover software integration. Hardware is a focus of 51%, while 42% focus on IoT connectivity in various forms.

3. Vertical focus

Different industries have different needs. A manufacturing company with a global network of plants has specific IoT system integration requirements that differ from an agricultural company or a healthcare company. Manufacturing clients are important to IoT integrators: 64% of IoT system integration companies focus on manufacturing, including smart factories, industry 4.0, and connected products. Transportation (e.g., connected car, vehicle-to-everything) is the second most common industry at 37%, followed by energy and utilities (e.g., smart metering and smart grid) at 34%.

Conclusion

The three dimensions highlighted in this article (company type, offering, and vertical focus) demonstrate the complexity and breadth of the IoT integration landscape. Few IoT integrators can do it all, but there is always someone with a niche focus.