Operators can do something "smarter" than just sell their towers to Cellnex, said Stéphane Richard, Orange's former boss, during an interview with the Financial Times in November 2020. Yet selling towers to Cellnex or Cellnex-like companies is precisely what many have done. As private equity and specialist "towercos" have advanced, Europe's telecom incumbents are swapping ownership for tenancy. Orange is one of the last holdouts.

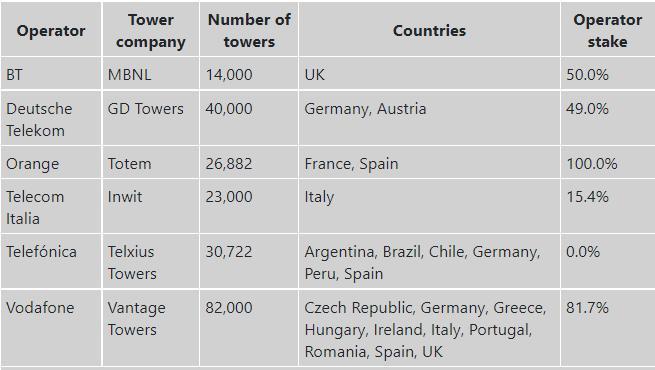

The French operator still has full control of Totem, a business it set up last year to manage some 26,882 towers in France and Spain. Among Europe's big six – BT, Deutsche Telekom, Orange, Telecom Italia, Telefónica and Vodafone – Orange is in a unique position. Every other one of those companies has divested tower assets in the last few years or was already sharing ownership in its main market.

Three of them have now ceded control. The most recent to give up majority ownership of what some would call a strategically important asset is Deutsche Telekom. On July 14, Germany's incumbent sold a 51% stake in GD Towers, a subsidiary owning about 40,000 towers in Germany and Austria, to DigitalBridge and Brookfield Asset Management.

Table 1: Telcos and their tower assets

Similarly, Telecom Italia is a minority stakeholder in its Italian towers venture (Inwit), while Telefónica has gone even further. Last year, it sold 30,722 towers in several countries to American Tower, another towerco, for €7.7 billion (US$7.8 billion). Today, the Spanish operator owns not so much as a single nut and bolt.

The Deutsche Telekom deal is an awkward reality for Orange. While Christel Heydemann, Orange's CEO since April, might have other ideas, Richard had dangled the prospect of a towers merger with Vodafone and/or Deutsche Telekom. By pooling their substantial European assets, those companies might have been able to create a regional towerco with the muscle of Cellnex, the most prominent dealmaker of the last few years. A tie-up with Deutsche Telekom no longer seems to be an option.

Different strokes

What's curious is why Richard felt so differently about owning towers than either Timotheus Höttges or José María Álvarez-Pallete López, his counterparts at Deutsche Telekom and Telefónica, respectively. Telefónica had made its decision to sell, Richard told analysts on a call in early 2021, because it did not consider those tower assets to be strategic. "This is not, clearly, our view," he added.

Of course, it is conceivable that Telefónica attached similar importance to its towers but was under greater pressure to sell in a market fixated on short-term performance. Even now, Telefónica holds €27.5 billion ($27.9 billion) in net debt, a sum that exceeds its market capitalization by about €900 million ($914 million) and is about 2.1 times its operating income (before interest, tax, depreciation and amortization).

Orange, prior to any divestment, has a bit more headroom with its valuation of €27.9 billion ($28.3 billion) and €24.2 billion ($24.6 billion) in net debt. That latter figure is about twice what it makes in annual earnings.

Höttges, meanwhile, seems to think he has mitigated the risks by extracting "significant minority protection rights" from the new owners of GD Towers. Among other things, Deutsche Telekom has the right to appoint two out of five members of the shareholder committee, including the initial chairman. Deutsche Telekom insists that it has also reserved the right to regain control and reconsolidate GD Towers in the future. But a minority stake is a minority stake. Fifty-one percent would sound more reassuring, and it is evidently what DigitalBridge and Brookfield wanted.

The main danger today is that lease payments are rising as towercos and private equity firms demand more from their tenants. "You first get good money for the sale of radio towers. And then? Then you have to rent them back, and the rents are constantly rising," said a telco insider, on condition of anonymity, in early 2021. Since then, supply-chain problems have worsened, inflation has soared and interest rates have risen.

Leases are not insignificant, either. Today, they account for about 5% of total operating expenses at a typical European operator, according to a new report from Moody's – roughly the same amount operators spend on energy.

"Inflation will also push up tower lease costs," said Moody's. "Those companies that have sold their towers and are subject to inflation-linked contracts with no caps are likely to feel more pressure. A higher inflation environment may test the relationships between tenant operators and tower companies that lie at the heart of the tower business model."

Existential crisis

More philosophically, tower deals add to the sense that traditional telcos are in decline. Many have already given up trying to operate their own cloud platforms, instead relying on hyperscalers for these and related features. Very few develop their own technologies or do anything original from a service perspective. None has the brand appeal of an Apple.

While some telcos are desperately trying to evolve into software companies, nobody would describe them as such today. If their property is not strategic, then what is?

For Höttges, the answer seems to be majority ownership of T-Mobile US, the part of Deutsche Telekom's business empire that has fueled its growth in recent years. Owning 50.1% of the American operator – a goal that looks more achievable after the towers deal – is more important to the Deutsche Telekom CEO than being in control of his European infrastructure. A quick look at recent performance may help to explain why. First-quarter sales in Germany rose less than 1% year-on-year. In the US, they were up nearly a tenth.

However, building that American business, including the takeover of Sprint in 2020, has come at a substantial cost. At the end of March, Deutsche Telekom's net debt, including leases, was a neck-craning €136 billion ($138 billion), exceeding the operator's market capitalization by nearly €42 billion ($42.7 billion). A deal that values GD Towers at about €17.5 billion ($17.8 billion) will chisel just €6.5 billion ($6.6 billion) off this debt mountain. Before too long, operators may find they are running short of assets to sell.